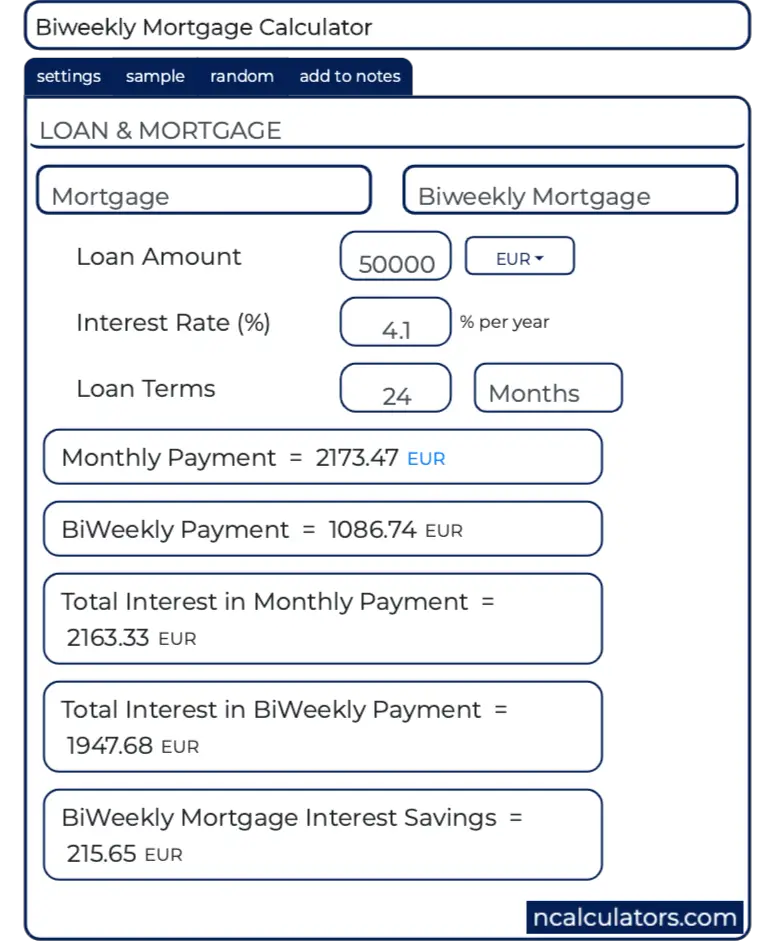

To estimate Accelerated Bi-Weekly payments, enter an Extra Payment that is equal to the normal Monthly Mortgage Payment divided by 12. This assumes no penalties for making prepayments. Derived from the amount borrowed, the term of the loan, and the mortgage interest rate.Įxtra Monthly Payment: The extra amount you want to pay towards the principal each month (a regularly scheduled prepayment). Monthly Mortgage Payment (PI): Consists of both principal (P) and interest (I). Initial Monthly Interest: The monthly interest payment will go down each month, but for purposes of comparing the interest to the principal payment, the initial monthly interest payment (and the initial monthly principal) is shown. Monthly Interest Rate: The monthly interest rate is calculated from the annual interest rate and the compound period. For example, to enter "10 years + 3 months", enter the following formula: =10+3/12įor Canadian mortgages, the definition of "Term" is different, so for Canadian mortgages you may want to change this label to "Amortization Period." You can enter a formula to a specify the number of months. If you enter your current mortgage balance in the Loan Amount, then enter the number of years you have left on your mortgage. Mortgages usually have 15 or 30-year terms. Term of Loan (in Years): The total number of years it will take to pay off the mortgage. This calculator assumes a fixed annual interest rate. You can also enter your current balance, if you also adjust the Term of Loan to be the number of years left to pay off the mortgage.Īnnual Interest Rate: This is the rate that is usually quoted by the lender. Loan Amount: This is the amount that you have borrowed. Canadian mortgage rates are quoted based on a semi-annual compound period (enter 2 for Canadian mortgages).

US mortgage rates are quoted based on a monthly compound period (enter 12 for US mortgages).

Compound Period: The number of times per year that the quoted annual interest rate is compounded.

0 kommentar(er)

0 kommentar(er)